Ben Zachariah

Twin-turbo V12 rumoured for Toyota’s Century coupe – report

1 Hour Ago

SPONSORED

For many small business owners, vehicles are essential tools of the trade – but owning them outright can tie up valuable cash in assets that lose value fast.

Between unpredictable maintenance bills, registration renewals, and the hassle of sourcing replacements, managing business vehicles can become an expensive, time-consuming drain on your operations.

That’s why a FleetPartners Fully Maintained Operating Lease* offers a smarter, simpler alternative – turning vehicle ownership into one predictable monthly cost, backed by expert fleet management support.

Buying or financing vehicles through traditional loans often means large upfront payments and ongoing depreciation.

With a FleetPartners Operating Lease, you can preserve your working capital and keep funds free for the things that truly grow your business – like hiring staff, marketing, or new equipment.

There’s no residual or balloon payment at the end of the term, and no need to worry about resale value. You simply hand back the vehicle and have the option to upgrade to something newer, safer, and better suited to your needs.

A FleetPartners Fully Maintained Operating Lease bundles all major running costs – registration, insurance, scheduled servicing, tyres, and roadside assistance – into one fixed monthly payment.

That means no unexpected repair bills or budgeting guesswork. Just a smooth, predictable expense that helps you manage your cash flow with confidence.

FleetPartners handles the full vehicle lifecycle – from sourcing and delivery to maintenance scheduling and end-of-term replacement.

You get access to fleet-level buying power, national maintenance networks, and ongoing support to keep your team on the road and productive.

For time-poor business owners, it’s an end-to-end solution that saves hours of admin each month.

With a FleetPartners Fully Maintained Operating Lease, small businesses can access new, purpose-built vehicles without locking up cash.

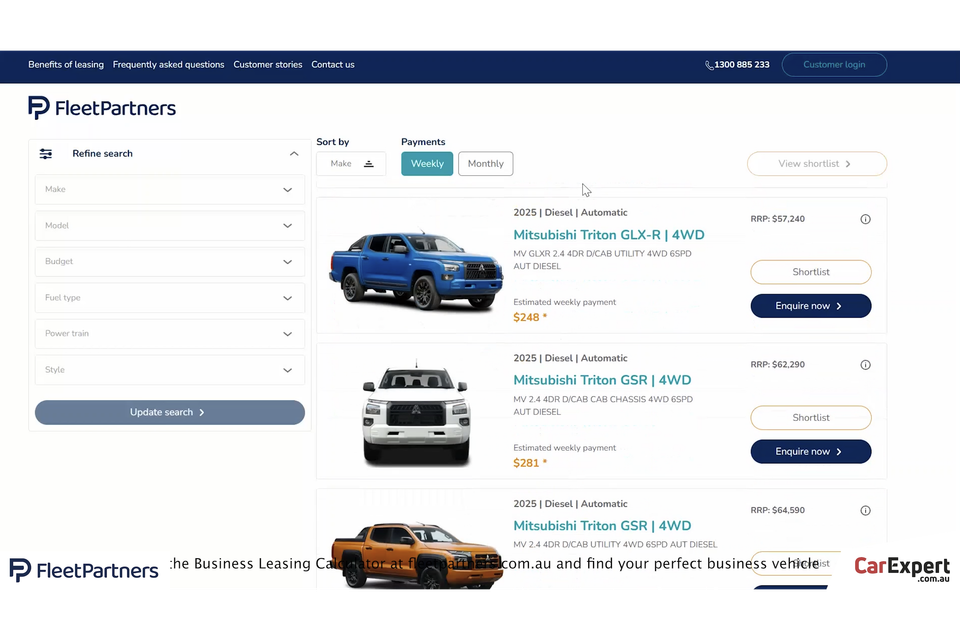

Whether it’s utes, vans, electric vehicles, or passenger cars, leasing means your fleet stays modern, efficient, and professional – projecting the right image to your customers.

FleetPartners makes it easier than ever to explore your options. The online Business Leasing Calculator lets ABN holders compare vehicles, estimate repayments, and start a credit application in just a few clicks.

It’s fast, transparent, and available 24/7, helping business owners make smarter, more strategic decisions about their vehicle costs.

FleetPartners is an ASX-listed company with more than 80,000 vehicles under management across Australia and New Zealand.

That means trusted expertise, national scale, and local support you can rely on.

With a FleetPartners Fully Maintained Operating Lease, you’ll have a partner who understands the unique challenges of running a small business – and helps you stay one step ahead.

* T&Cs, eligibility and credit criteria apply. Independent advice should be sought

Ben Zachariah

1 Hour Ago

William Stopford

1 Hour Ago

CarExpert

2 Hours Ago

Damion Smy

3 Hours Ago

Damion Smy

9 Hours Ago

William Stopford

17 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.